The more you know about assets and the roles they play in your organization, the easier it is to understand how to get maximum value from them at every stage of the life cycle.

And for the maintenance department, it pays to start with the basics, including understanding the definitions and demands of fixed assets.

What is a fixed asset and how do you identify them?

You can understand fixed assets in different ways, including:

- Where they land on the balance sheet

- How companies plan to use them

- How long companies plan to hold them

- What other names companies call them

- Which accounting practices affect them

Fixed assets are not current

On the overall balance sheet, companies include assets, liabilities, and shareholder equity. In fact, that’s basically where the name comes from; the balance sheet is where you’re weighing what you have against what you owe.

The asset column contains two subcategories, current assets and non-current assets. The names can be a bit confusing because current sounds like it’s describing assets a company currently has. Non-current sounds like assets they might have had in the past or plan to have in the future. There is an element of time to both definitions, but it’s related to how quickly the company could convert an asset into cash.

Companies can take their current assets and sell them for cash in less than a year. For non-current assets, it would be much more difficult and take more time to sell them. Non-current assets include long-term investments, intangible assets, and fixed assets.

Fixed asset help generate income

Just because it would take the company longer to sell them doesn’t mean non-current assets, including fixed assets, have less value. In fact, companies invest in fixed assets specifically to generate income.

Fixed assets are PP&E

That’s also a big part of the definition of fixed assets. Companies use them to generate income, which is why companies often refer to fixed assets as property, plant, and equipment (PP&E).

Fixed assets depreciate over time

Fixed assts tend to lose value over time because as physical objects, they’re subject to wear and tear.

So, the pump the company bought and installed last year is no longer worth what you paid for it. And the older it gets, the less it’s worth. It’s not just age; it’s also use. So, a car in your fleet that’s three years old might be worth more than one that’s only two but has four times the mileage.

Although fixed assets lose value over time, they don’t stop helping the company produce income. So, both those cars might be worth less than what you originally paid for them, but they’re still out on the road for deliveries.

The accounting department combines these two facts, a fixed asset is worth less over time but still generates income, to stretch the initial cost out across accounting periods. Instead of putting all the purchase price in one spot, it breaks the price into parts, and then spreads them out over time.

One advantage for the accounting department is there’s now a closer temporal connection between the money the company spent on an asset and the income that asset generates. But the big advantage is that depreciation helps the accountants better handle tax obligations.

What are examples of fixed assets?

You can also get a feel for what fixed assets are by looking at different ones from different industries.

Examples include:

- Vehicles for transportation and fleet

- Cranes and bulldozers for construction

- Forklifts for inventory and warehouses

- Tractors for farms and agriculture

- Solar panels for energy

- MRIs for hospitals and healthcare

- Presses and pumps for manufacturing

A lot of those are assets that move, which helps clear up any possible confusion around the meaning of “fixed.” This type of asset do not have to be stationary.

How can you get the most value from your fixed assets?

Your company invested in fixed assets to generate income. So, if you want to get the most value from them, you need to maintain them efficiently, getting the most uptime for the least amount of time and money.

In the short term, by cutting unscheduled downtime, you can avoid costly failures, rushed orders for parts, and overtime hours for both maintenance techs and machine operators.

But good maintenance also has long-term benefits. The better you maintain a fixed asset, the longer it lasts. And with fixed assets, because the accounting department can use depreciation to better manage the company’s tax obligations, longer life cycles deliver benefits across departments.

The accounting office gets more chances to use depreciation. And the finance department can wait longer before having to invest in replacement assets.

How does an EAM benefit fixed asset management?

Traditional maintenance management planning and tracking on paper and spreadsheets create liabilities your company cannot afford. With paper, data generation is slow and, because everything is manual, prone to costly mistakes. With spreadsheets, it’s a constant race to keep all that disconnected data up to date. In the end, not only are most people working with stale data sets, but they don’t realize it. They are both out of the loop and convinced they’re inside it. Enterprise asset management solutions leverage recent technological developments to deliver reliable data that’s both secure and accessible. Because all your data lives safely in one central database, the entire organization, including the maintenance and all other departments, are working from a single source of truth where every change is reflected in real time.

Enterprise asset management solutions leverage recent technological developments to deliver reliable data that’s both secure and accessible. Because all your data lives safely in one central database, the entire organization, including the maintenance and all other departments, are working from a single source of truth where every change is reflected in real time.

Modern EAM software helps you keep everyone effortlessly in the loop.

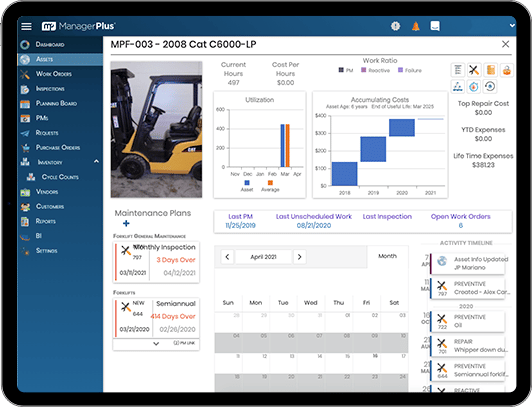

With robust modules for managing asset data, work orders, preventive maintenance programs, inventory control, and resources, you are always in control of your maintenance operations.

And with data you can finally trust, you have the tools you need to turn raw numbers into actionable business intelligence.

Next steps

Set up a call with one of our experts to discuss how ManagerPlus can help you take charge of your asset management.

Summary

Fixed assets are a type of non-current asset, which means companies could not quickly turn them into cash, invest in them to generate income, and because these assets lose value over time because of wear and tear, companies can use the accounting practice of depreciation to spread the initial cost out over a longer period, helping them better manage their tax obligations. Because these assets are there specifically to help the company generate income and a longer life cycle delivers tax benefits, it’s critical for companies to properly maintain fixed assets. A good maintenance program cuts unscheduled down time and lengthens useful life. Modern EAM solutions give maintenance departments the combination of features and modules, including work order management and inventory control, to keep everything up and running.