Across industries, understanding what type of assets you have and knowing how to track them is crucial.

And a big part of that is understanding the differences between current and non-current assets, the roles they play in your business, and how to manage them.

What are business assets?

A business asset is any item or resource that your business owns, has a monetary value, and helps the business function. Assets differ from business to business depending on what those businesses do, how they operate, and their position in the supply chain.

Business assets can range from inventory and cash to state-of-the-art equipment, buildings, and intellectual property. You can generate value by operating, monitoring, maintaining, and selling those assets through the process of asset management.

What are the differences between current and non-current assets?

The main difference between non-current and current assets is longevity.

Non-current assets, also known as fixed assets, are assets that your business holds for longer than 12 months and uses as a source of long-term revenue generation. They usually have a high value, benefit the business for long periods, and cannot quickly be turned into cash.

Current assets are items that your business uses in its day-to-day operations and owns for less than 12 months. You use current assets to generate cash flow for the business and you can liquidate them quickly to fund your ongoing operations and cover your expenses.

On top of longevity, there are also a few other differences between non-current and current assets:

Valuation

You can value non-current assets by subtracting the accumulated depreciation from their purchase price.

Your current assets have a market value, i.e. a price they can be sold for at the time.

Taxation

Your non-current assets are taxed as capital when you sell them and you pay capital gains tax.

Your current assets are taxed as revenue when you sell them and you pay corporate income tax.

Depreciation

Your non-current assets usually depreciate over time and their value reduces gradually on the balance sheet.

Your current assets do not depreciate but their market value can rise and fall.

What are examples of non-current assets?

Non-current assets can be both “tangible” and “intangible.” Tangible non-current assets are the physical property, plant, and equipment that the business owns. They are the main form of assets in most industries and include:

- Buildings

- Land

- Machinery

- Vehicles (company cars, trucks, forklifts)

- Tools

- Computer equipment

Intangible non-current assets are things that your business holds that do not have a physical form. They provide value to your business but it can be difficult to convert them into cash. For example:

- Trademarks

- Patents

- Long-term investments

- Goodwill

- Brand recognition

- Customer lists

Even licenses and permits fall into the category of intangible non-current assets.

What are examples of current assets?

You can also split current assets into two subgroups: “liquid” and “more liquid.”

Your business can convert liquid current assets into cash within a period of 90 days to one year. Examples include:

Your business can convert liquid current assets into cash within a period of 90 days to one year. Examples include:

- Inventory

- Prepaid expenses

- Accounts receivable (more than 90 days)

- Short-term investments

Assets that you can convert into cash in less than 90 days are known as more liquid current assets. Examples are:

- Cash and cash balances

- Bank deposits

- Accounts receivable (within 90 days)

The most liquid asset in your business is cash in hand. That’s followed closely by money that you can withdraw from your business’s bank account.

Why is managing your assets so important?

Asset management is the process of tracking, monitoring, and managing your assets to streamline your operations and deliver optimal returns from their sale or disposal. Managing your non-current and current assets, such as vehicles, equipment, inventory, and investments, helps to ensure that you can account for your available assets. It also enables you to identify and manage all of the associated risks so you can better protect their value.

Here are just a few of the reasons why businesses should take an active role in managing their non-current and current assets:

Account for all your assets

Implementing asset management makes it easier for businesses to keep track of their current and non-current assets. It helps you to know where your assets are, how they are used, what changes have been made to them, and what improvements they require (if any) to protect the value of your assets and make the process of liquidating them more efficient.

Improve the accuracy of your financial statements

Regular tracking, monitoring, and maintaining your assets gives you a clearer view of their value. It also helps you to record amortization and depreciation rates accurately in your financial statements.

Identify and managing risks

Identifying and managing the risks that arise from the ownership and use of your assets is an important part of the asset management process. Understanding those risks helps to protect the value of your assets and overcome the challenges that come along.

Remove ghost assets from your inventory

You can all too easily record lost, damaged, or stolen assets in your business’s books. Putting an asset management plan in place gives you an accurate view of the value of your assets at all times so you can make more informed decisions.

Enhance loss prevention

Asset management makes the process of identifying and tracking the assets stolen by employees or customers easier. Although large, non-current assets such as vehicles and machinery are difficult to remove, tools and current assets like cash and inventory can be stolen. Asset management enables you to detect when items disappear and prevent loss in the first instance.

How can asset management software help?

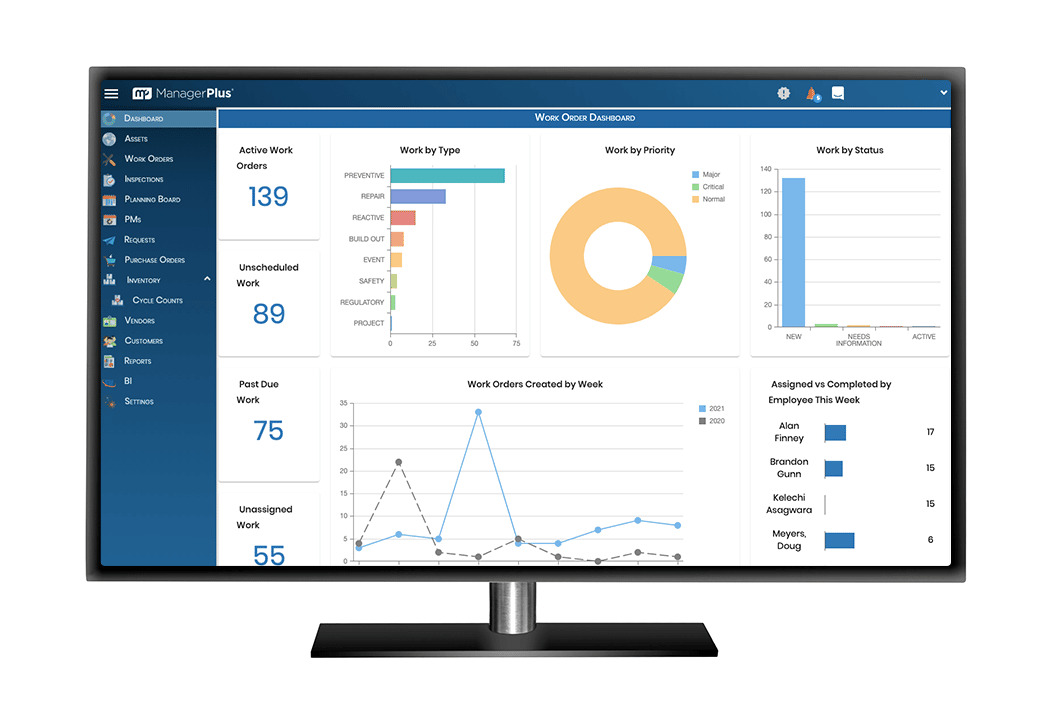

Asset management software is a simple and centralized way to monitor and manage all of your business’s assets. It allows you to manage non-current and current assets from a single solution so you can take charge of your assets and create a more efficient operation. ManagerPlus® enterprise asset management software helps you streamline your equipment management and optimize maintenance workflows. It enables you to gain valuable insights into how well or how poorly your assets are performing. You can also optimize your asset portfolio using historical data and actual efficiency, broken down by asset type.

ManagerPlus® enterprise asset management software helps you streamline your equipment management and optimize maintenance workflows. It enables you to gain valuable insights into how well or how poorly your assets are performing. You can also optimize your asset portfolio using historical data and actual efficiency, broken down by asset type.

What’s more, your maintenance team can communicate seamlessly wherever they are to close the loop on all of your asset-related tasks and create a single point of truth.

Next steps

Want to find out how ManagerPlus can help you take control of your current and non-current assets?

We’re here to help. You can book a live demo or schedule a consultation with one of our experts.

Executive summary

An asset is any item or resource with a monetary value that a business owns. Current assets are those that you can convert into cash within one year, such as short-term investments and accounts receivable. Non-current assets are longer-term assets with a full value that you cannot recognize until after one year, such as property and machinery. Non-current assets can be both “tangible” and “intangible”, that is, things you can physically see and touch as well as resources that do not have a physical form. Current assets are categorized as “liquid” or “more liquid” depending on how quickly you can convert them into cash.

Managing your business’s current and non-current assets is an important step in streamlining your operations and delivering optimal returns from their sale or disposal. Enterprise asset management software from ManagerPlus can help you get the most from your assets. It simplifies the process of optimizing your asset operations to help you increase uptime, extend the life of your equipment, and make your business’s assets more efficient and valuable.