The benefits of insuring your fleet are obvious, but there’s a lot that goes into finding and managing the fleet insurance policy that works best for you.

Let’s start with the basics and then build from there.

What is fleet insurance?

One of the most important tasks for fleet managers is finding the right level of insurance coverage for each vehicle at the best possible price. That’s where fleet insurance can help. Fleet insurance allows organizations to collectively protect all their vehicles under a single policy rather than individually. Grouping all your vehicles together under a single policy makes everything easier to manage, saves you time, and reduces your costs.

You can use fleet insurance to cover vehicles that are owned or leased by the business, and the policy can be registered in the name of the organization, the business owner, or a director. Payments are annual or month, and specialist brokers and comparison sites can help fleet managers find the best deal.

How many vehicles do you need for fleet insurance?

Your organization needs at least two vehicles to buy a fleet insurance policy. The term “fleet” typically refers to anything from two to 500 vehicles, but the upper limit can be higher than that depending on the insurer.

A single policy can cover a mixture of vehicles, including cars, vans, SUVs, pickups, rigs, heavy haulers, and even industrial vehicles.

Who can drive with fleet insurance?

You can include any driver on a fleet insurance policy as long as they have a license to drive the relevant category of vehicle and are permitted to do so by the business. Most fleet insurance policies are issued on an “any driver” basis that lets any employee drive the business’s vehicles. It’s typically a good fit for larger businesses because it cuts down on paperwork. If they have the rating and permission, they can drive the vehicle.

The only problem you might have is with insuring younger drivers or those with previous driving convictions. Although most insurers will cover these types of drivers, you may find that your fleet insurance premiums increase.

So, does my fleet insurance cover all my drivers?

That depends on the type of policy. You can choose between “any driver” and “named driver” policies. When you choose between the two, you have to factor in the type of business you run, your budget, and your preferences.

Any driver policies

This type of policy typically comes with higher premiums but offers more flexibility as it allows any driver to drive the vehicles owned by the business. This can be beneficial for larger businesses that can struggle to assign drivers to specific vehicles. To keep your premiums down, some insurers allow businesses to have any driver policies that include the majority of drivers but restrict higher-risk drivers who are named to specific vehicles.

Named drive policies

For smaller businesses, it usually makes sense to choose a named driver policy, which attaches every driver to a certain vehicle. The main advantage of this type of policy is that it’s cheaper because the risks posed by younger drivers or drivers with convictions are restricted to just one or two vehicles.

Is it cheaper to get fleet insurance?

Yes. Insuring your vehicles under a single fleet policy usually ends up being considerably cheaper than insuring them individually. The price you pay for fleet insurance varies based on factors such as the type of vehicles in your fleet, their purpose, your fleet’s claims history, and the risk profile of your drivers.

As an example, you’d ordinarily have to pay more to insure a delivery fleet than an equivalent service fleet. That’s because delivery drivers are under pressure to make multiple drops on tight deadlines, which increases the risks when compared to fleets that drive fixed and pre-planned routes.

How you manage the risks that your fleet presents also impacts the amount you pay. The more you do to minimize those risks, the lower your premiums are. For example:

- What steps do you take to vet your drivers?

- How much driver training do you provide?

- How do you manage and monitor driver behavior?

- Do you use telematics solutions and how do you use that data?

- Are your vehicles fitted with forward-, side-, and rear-facing dash cams to confirm who is at fault if an accident occurs?

- Do your vehicles have built-in technology such as lane assist and emergency braking systems?

How to choose fleet insurance?

Choosing the right fleet insurance for your business is all about understanding the different coverage that’s available and tailoring a policy that meets your specific needs.

The first step is to research your state’s legal requirements to find out the minimum level of liability coverage a business must carry.

The liability coverage that you must have by law can include:

- Property damage liability: protects you if one of your vehicles damages another person’s property.

- Bodily injury damage: protects you financially if one of your vehicles is involved in an accident that injures or kills a third party. It may also cover the cost of legal fees.

- Combined single limit (CSL) coverage: provides the same dollar amount of coverage for property damage and bodily injury.

While the legal requirements for fleet insurance are focused on liability coverage, there are also some policy extensions and adjustments that provide further protection for your business.

- Product insurance: If your business transports goods, then you’ll probably need coverage for your cargo. This is something that most customers will expect to be in place before they agree to work with you.

- Physical damage coverage: Weather events, theft, vandalism, and other events that can damage your vehicles are not protected by liability insurance. That’s where physical damage coverage comes in.

- Uninsured motorist coverage: Unfortunately, there are many more uninsured drivers on our roads than we’d all like. This policy extension protects you if one of your vehicles is damaged or a driver is hurt due to a collision with an uninsured driver.

- Roadside assistance: If your drivers and vehicles travel across the state or even the country, then roadside assistance is a bolt-on to your policy that’s well worth considering.

Managing your fleet insurance

A lot of thought goes into choosing your fleet insurance policy, but that’s half the battle. Once you have your policy in place, you need to think about how you can manage it effectively to keep it cost-effective, up to date, and compliant.

“Any driver” policies allow any employee to drive your vehicles, but you still need to update your policy when you add new vehicles to your fleet. Smaller businesses with “named driver” policies must keep a list of the employees authorized to operate certain vehicles. For that reason, you must keep track of who is on your policy and notify your insurance provider of any new hires or staff changes.

It’s also important to schedule your renewals. You must renew fleet insurance annually, semi-annually, and in some cases even monthly. When you have a busy fleet to manage, keeping track of all that can be difficult, and that’s where ManagerPlus® can help.

Simplify your fleet with ManagerPlus

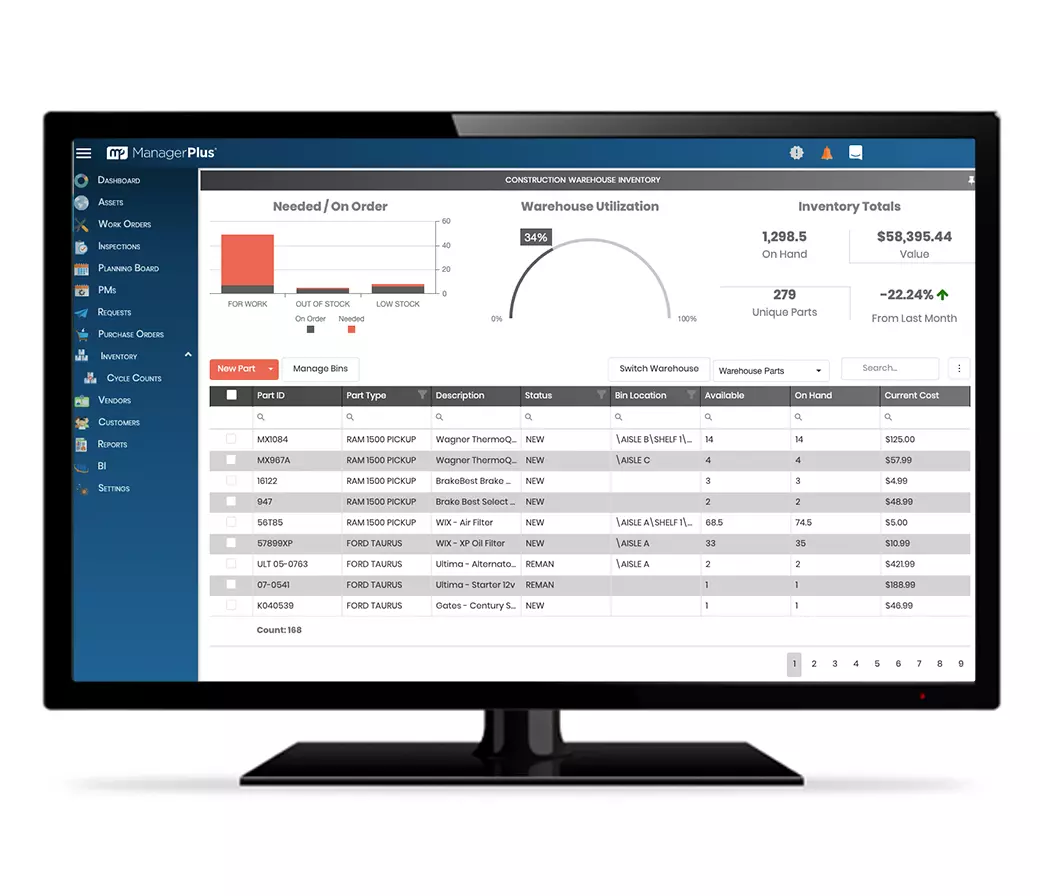

Fleet managers can track all aspects of their fleet with ManagerPlus. Our fleet management software can help you handle everything from giving service technicians step-by-step instructions to calculating the total cost of ownership, and collecting real-time Driver Vehicle Inspection Reports.

You can also set up automatic insurance renewal reminders, schedule routine maintenance work, and keep track of every aspect of your vehicles while they’re on the road. Start your free trial of ManagerPlus or request a demo to take control of your fleet today.

Executive summary

Fleet insurance helps you protect all the vehicles owned by your business under a single policy and is usually much cheaper than insuring them individually. You can tailor your policy to suit the specific needs of your business and choose an “any driver” or “named driver” policy. When it comes to managing your fleet insurance, ManagerPlus fleet management software simplifies the process. It allows you to automate insurance renewal reminders, schedule routine maintenance work, and keep track of every aspect of your vehicles while they’re on the road.