You can’t fully optimize your assets until you know how much they’re costing you, and there’s much more to the cost of an asset than just the purchase price.

Determining the total cost of ownership (TCO) for your assets is the first step in figuring out which assets are costing you more than they should and where you can better invest your money.

Calculating TCO isn’t inherently difficult, but there are several things to consider.

What is Total Cost of Ownership (TCO)?

Total cost of ownership (TCO) is a method used for determining which assets are most cost-effective for your business. You can use TCO to figure out if certain assets are costing you more to maintain than they should and if it might be time to replace them.

In basic terms, TCO is the purchase price of an asset plus the costs of operating and maintaining it. Every dollar you spend to purchase, operate, and keep it running over the course of its useful life is part of its TCO.

It’s important to make sure you consider all the costs associated with maintaining your assets in order to calculate an accurate TCO including labor, parts, and vendor expenses.

Every company’s operating and maintenance costs may vary, but make sure you’ve included as many things as you can think of to ensure you’re getting the most accurate calculation.

Why TCO is valuable to your asset management

Determining the true cost of owning your equipment will help you optimize your asset management program. Knowing expected costs can help you better plan ahead and spot potential issues before they lead to downtime.

It can help you discover things like gaps in your technician’s knowledge or your maintenance program allowing you to determine where you can improve productivity and profitability.

How to calculate total cost of ownership

As we mentioned previously, TCO is the total cost of all operational and maintenance activities for an asset plus the initial purchase price.

So:

Purchase price

This is the total initial investment for the asset including warranties and depreciation over time.

Operating costs

You’ll need to consider every cost associated with keeping the asset running. For example, vehicle costs include fuel, insurance, registration fees, etc.

Maintenance costs

Make sure your maintenance costs include:

- Labor (hourly rate of technicians multiplied by total hours spent performing inspections and repairs), plus the cost of any vendors needed to perform specific repairs

- Parts and materials

- Equipment downtime (the total number of hours the equipment is offline, multiplied by the value of lost equipment output)

This will give you an idea of the TCO for each asset, but you also need to know which assets are more cost-effective than others.

No two assets are used exactly the same way. Some are used far more frequently than others, so it’s only natural that they might have a higher TCO. However, they could be far more valuable to your organization than a similar asset with a lower TCO.

To make a fair comparison, you’ll also need to add asset utilization into the equation.

How to determine asset utilization (cost per hour)

It’s critical to track each asset’s run time, whether you measure this by miles or hours.

First, you’ll need to know the purchase date and the date you began using the equipment. These could be the same dates, but it often takes at least a few days to bring an asset online. The date you began using it up to the current date (or the date you brought it off the road or offline) is the total time in service.

Once you’ve determined the TCO for each asset, you can divide that by the total run time or total miles to get the total cost per hour/mile.

If one machine had a total cost of ownership of $100,000 and you used it for 2,000 hours in the past year, your total cost per hour would be $50.

If you had a vehicle with the same total cost of ownership that traveled 100,000 miles, your total cost per mile would be $1.

Once you know the cost per hour, you can determine averages for different types of equipment and begin to spot outliers.

How to filter for other factors

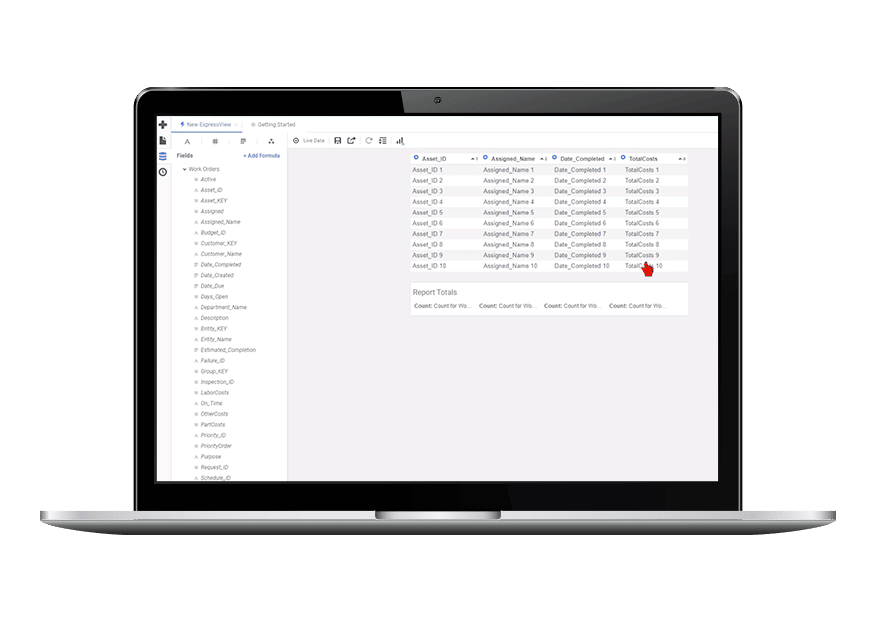

A good enterprise asset management (EAM) software solution can generate these asset utilization reports for you so you can see your asset costs at a glance. You can also create custom reports to help you make other data-driven decisions.

With these reports you can:

Consider the age of assets into your cost calculation

Factoring in the age of your asset as you calculate TCO will give you a more accurate picture and a basis for comparison. Assets that are five years old will have a different inherent value than those that are only a year old, even if both had the same run time.

You can create a custom report that assigns a score to each asset based on age so you can quickly identify which assets may be nearing the end of their useful life.

Identify the assets with the highest work order costs

When you know which assets are costing your organization significantly more work to repair than others, you can start to identify underlying issues and take proactive steps to address them.

For instance, you may discover one asset has a faulty component that has been replaced several times and take steps to find a long-term solution.

Determine how your costs are contributing to your overall output

Obviously, the more uptime you get from your assets, the more products they are producing.

By comparing equipment uptime to the total cost of ownership , you can see whether an increase in costs is actually contributing to better equipment performance and higher production output.

Track time to failure and time to repair

Depending on the types of assets you have, to get an idea of the overall failure and repair costs of your assets, there are a few different metrics to look at.

Mean time to failure (MTTF)

MTTF is a measure used to calculate the average time it takes for a family of non-repairable assets to fail. You would generally use this in cost calculations for assets like light bulbs or fan belts. They are assets that either can’t be repaired or the cost of repair is greater than the cost of replacing.

Using light bulbs as an example, you could calculate MTTF by dividing the total hours of operation by the total number of assets in use.

This would mean that you are getting about 1000 hours of use from your lightbulbs on average.

Mean time between failures (MTBF)

This metric is used to determine the average amount of time between failures that can be repaired for an asset. This is used generally for larger assets where a failure does not result in the entire asset needing to be replaced.

Think of a machine press in a manufacturing facility. Many parts of the machine can be replaced quickly and inexpensively without having to replace the machine itself.

So let’s say you wanted to know what the MTBF was for one of your machines over the past year. You would divide the total number of hours, or miles for vehicles, that the machine operated by the number of failures that needed maintenance work.

This essentially means that you’re getting about 6,000 hours of full run-time from that machine without having to perform any repairs.

Mean time to repair (MTTR)

The MTTR calculation is used to find out the average time it takes your technicians to repair your assets in a given period of time.

To calculate this, you would divide the number of unplanned repair hours by the total number of repairs needed.

For example, your assets experienced 30 failures over the past month and your technicians spent 10 hours repairing them.

This means that over the past month, your technicians spent about 20 minutes on each repair.

Generally, MTTF and MTBF are used to measure equipment reliability, while MTTR measures the effectiveness of your maintenance team.

Calculate overall equipment effectiveness (OEE)

Overall equipment effectiveness is the percentage of time your equipment is productive and generating revenue for your company. This calculation takes into account three factors:

- Availability – The percentage of time your equipment is actually running as planned (Run time/production time)

- Performance – A measure of how close your equipment is to running at its maximum speed (Ideal cycle time x total count of parts produced)/run time

- Quality – How well the parts your equipment produces meet your standards

(Good count/total count)

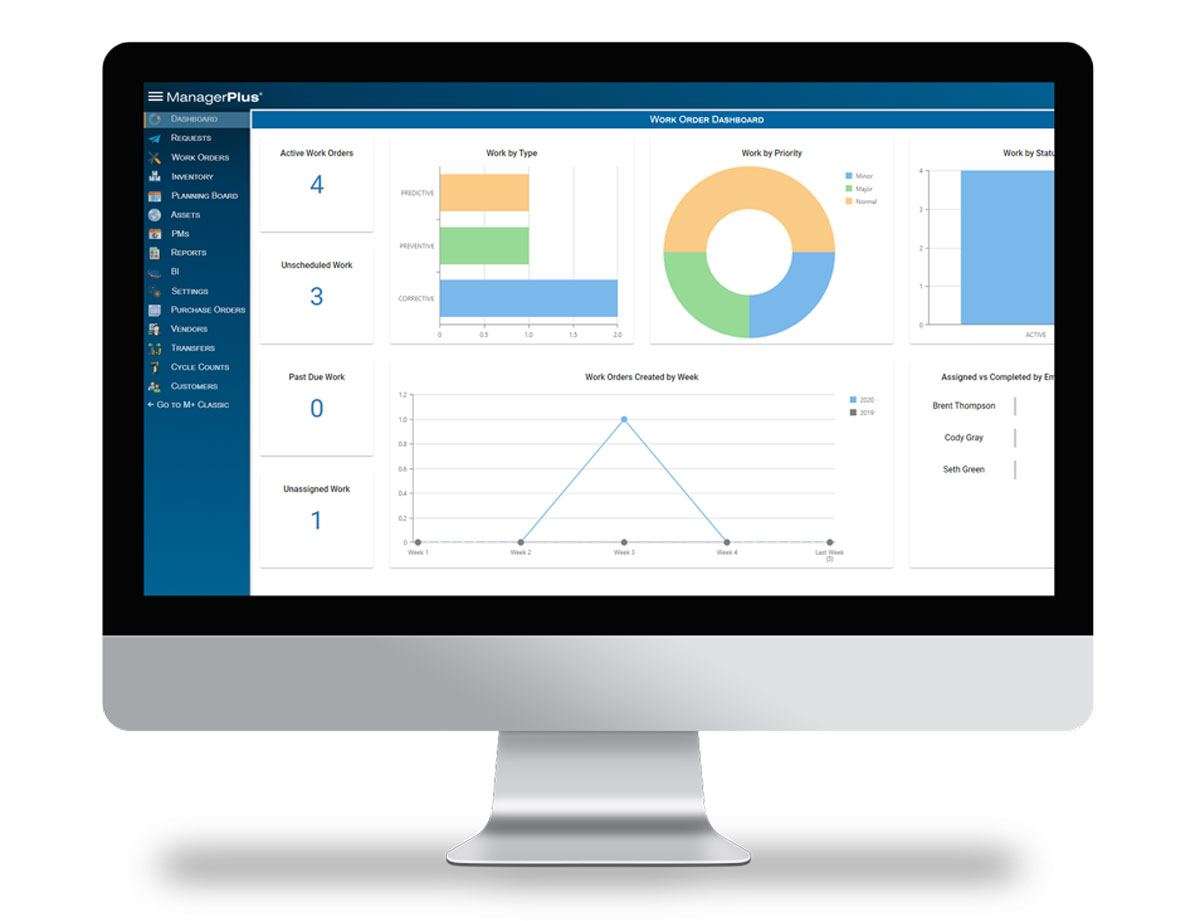

To calculate overall equipment effectiveness, you’ll need to multiply these three factors together. To determine equipment availability in ManagerPlus, you will need to run a report that shows total equipment downtime for a certain time period. Then you can use performance logs and quality data to complete this calculation.

How to decide what equipment to run to failure

Understanding the total costs of ownership for your assets helps you make more informed decisions about whether to repair or replace equipment.

It can also help you create a more cost-effective and efficient preventive maintenance strategy. While preventive maintenance extends the useful life of many assets, it may not be necessary for everything you own. Assets like batteries and light bulbs are designed to be replaced after several months or years, and most are relatively inexpensive to replace.

Assets with low capitalization rates, such as mobile devices, generally have a few parts that may need to be replaced at some point, but by then, it’s usually more cost-effective to replace the entire device.

As you consider what to run to failure, keep in mind the replacement cost, whether it outweighs the cost of repairs, and whether the asset is a capital expense or an operating expense.

How ManagerPlus can help

ManagerPlus EAM software makes it easy to track every detail of your assets, from the purchase price to the salvage value.

You can schedule maintenance tasks at recommended intervals, based on equipment age or run time, and keep track of your entire inspection and work order history.

You can also track equipment failure, labor costs, and the costs of parts for a full picture of your total costs of ownership.

You can create standard reports or customize them to better align with your equipment replacement strategy.

When you understand TCO and overall equipment effectiveness, you can make smarter asset management decisions to reduce costs and improve ROI.

What do I need to know?

Total cost of ownership (TCO) is a calculation to help you determine which assets are most effective for your business and which ones it might be worth replacing.

It is the sum of the purchase price, the operating costs, and the maintenance costs for your asset.

Calculating TCO for your assets can also help you identify the proper maintenance strategy for each one.

Ready to start saving with equipment management software that works as hard as you do? Request a free, personalized demo today.